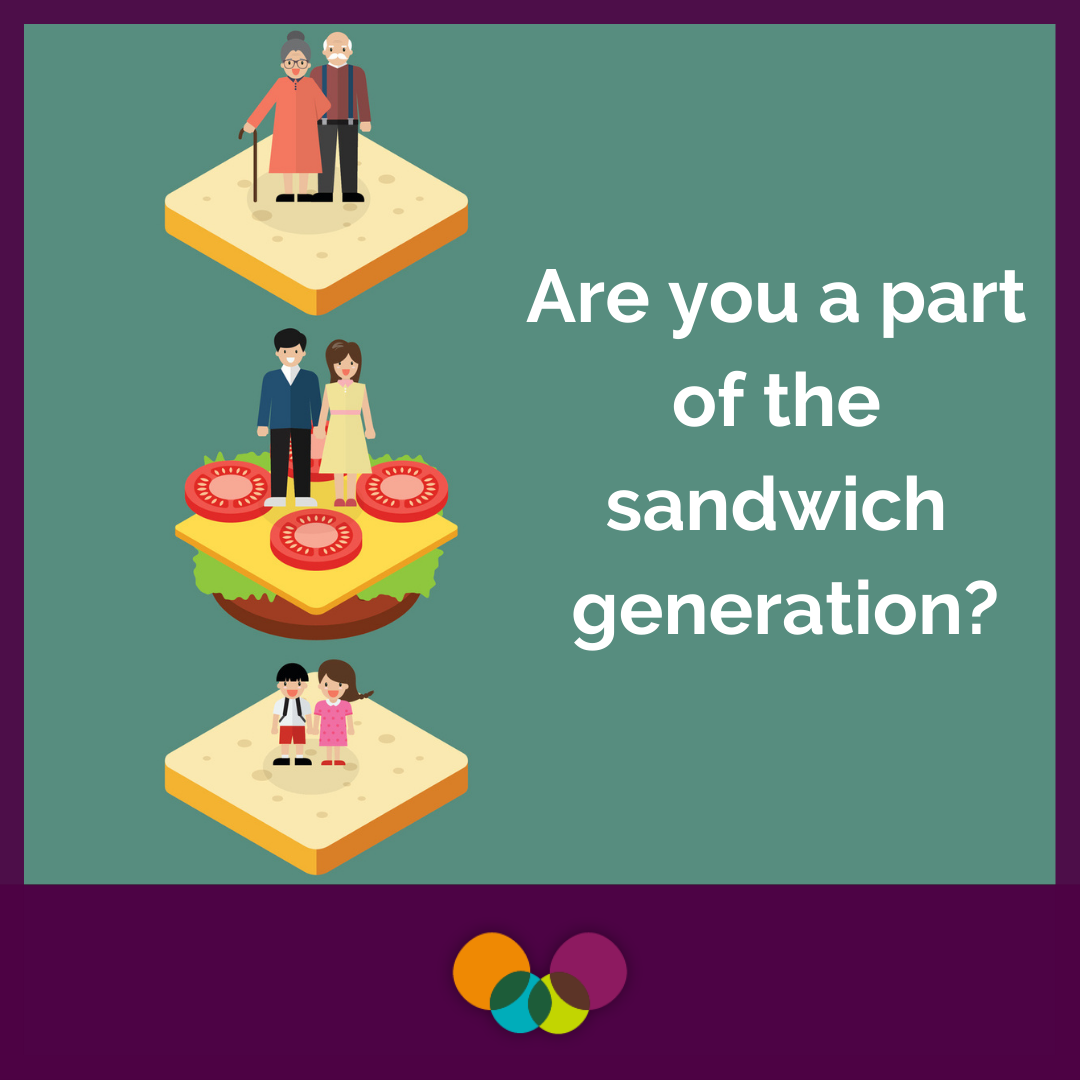

Are you a part of the sandwich generation – stuck between raising kids and caring for aging relatives at the same time? Being sandwiched between caregiving responsibilities can be very tough for your physical, mental, and financial health. We have put together some tips to try to help you plan ahead and get through these challenges.

Talk to Your Parents

You may not have a choice on whether you must take responsibility for your aging parents. It won’t be a comfortable conversation, but you should speak to them about future caregiving plans, especially how to pay for it. Gather information and details from their life insurance and other estate planning they may have. Also, if you have siblings or other close family members that could assist, create a clear plan on how each person will be helping out.

Talk to Your Kids

Work on budgeting with your kids at an early age so they can begin to understand the larger picture of what finances the family will need as they get older. From everyday activities to their first car, and college, set up expectations on budgeting and who will be responsible for paying for each item.

Take Care of Yourself

Caring for others can be very draining on your physical, mental, and financial health. Make sure you have an emergency fund to cover expenses for you and your children. Experts recommend a savings of three to six months worth of expenses to be set aside. If you anticipate being the caregiver to your parents in the future, start a separate fund specifically for these goals.

What to do if You are Already in the Sandwich?

If you are already caring for both kids and aging parents, try to create a work-life balance the best you can. Perhaps there are options for flexible hours or family leave options that you can take advantage of to have more time for yourself and your family.

In the middle of this busy time, don’t forget about yourself. Make sure to keep up your savings towards retirement, to secure your future needs.

Offset Your Costs

There are deductions and credits that can help offset the cost you incur for caregiving. If you are not sure what they are, contact your accountant to help you. Also, reach out to your financial institution and ask about opening a special FSA account. Use this to put away pre-tax dollars for dependent care such as daycare for kids or seniors, a nanny, and after-school programs.

If you have any questions please call a Member Specialist today at 800–422–5852 or visit our website.