Identity theft is a serious crime. It’s important to take the proper steps to protect your personal and financial information. Tax season is in full swing and important documentation will be arriving for your returns. You can avoid being a victim of tax identity theft. Gather all your documents as quickly as possible and file your return quickly. Tax identity theft happens when someone uses your Social Security number to file a fake tax return to collect your refund before you do. Protect yourself with these tips and red flags to look for to protect yourself and avoid tax identity theft.

Get an Identity Protection PIN (IP PIN) from the IRS.

An IP PIN is a six-digit number assigned to eligible taxpayers. It helps prevent the misuse of your Social Security number on fraudulent federal income tax returns.

Check your mail and credit union account statements every month.

If you discover a red flag, contact the financial institution immediately. This could include an account you did not open, a balance discrepancy, or a purchase you did not make.

Talk to your credit union about the identity theft resources they may offer.

Most credit unions offer services and materials to help their members safeguard their accounts.

Look out for communication from the IRS.

An unexpected notice or letter from the IRS could alert you that someone else is using your SSN. The IRS will NOT contact a taxpayer by sending an email, text, or social media message that asks for personal or financial information. If you get any of these types of communication, do not reply or click on any links. Instead, forward it to phishing@irs.gov.

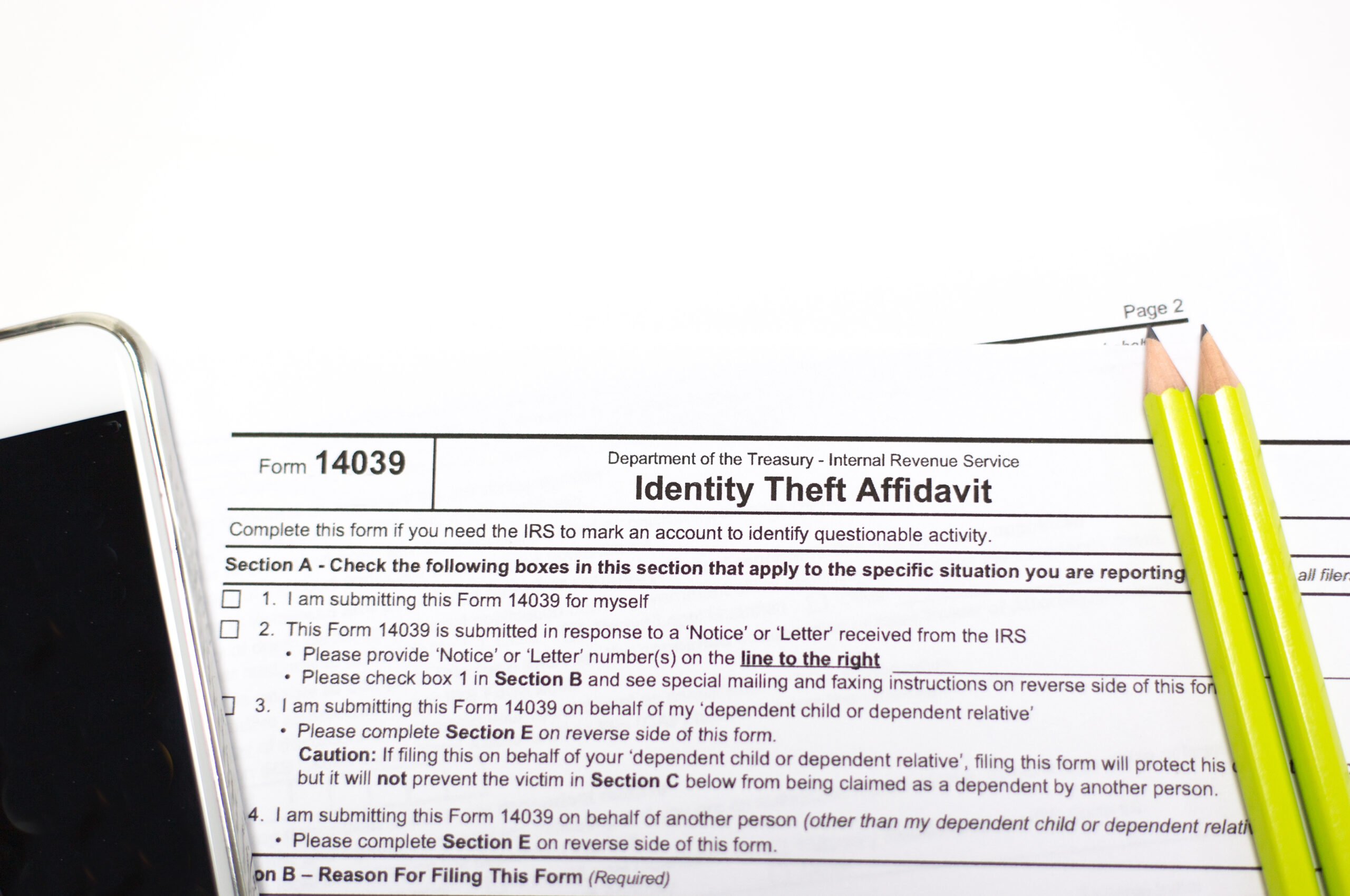

If someone uses your SSN to file for a tax refund before you do, the IRS records will show the first filing and refund, and you’ll get a notice or letter from the IRS saying more than one return was filed for you. If someone uses your SSN to get a job, the employer may report that person’s income to the IRS using your SSN. When your tax return doesn’t reflect those earnings, the agency will send you a notice or letter saying you got wages but didn’t report them.

If you think someone used your SSN for a tax refund or a job, contact the IRS immediately. The IRS Identity Protection Specialized Unit can be reached at 1-800-908-4490. This is especially true if the IRS sends you a notice or letter indicating a problem. If you have any other questions on how to protect yourself from financial fraud, visit our website, read our other fraud prevention articles, or call a Member Specialist today at 800–422–5852.